Will AUGA M1 tractors be able to get out of the promise-soaked soil with loans?

Lots of lights, pomp and advertising. Three years of plans for mass production of tractors and, finally, the entrapment of interest groups. The story around the „AUGA group“ hybrid tractor „AUGA M1“ is more like a prop, and the ambition to obtain 60 million euros for the development of the tractor project through ILTE (formerly „Invega“) raises serious doubts for the Lithuanian Association of Agricultural Machinery.

A hopeless and unviable project?

Information that AB „AUGA group“ through its subsidiary „AUGA tech“ is seeking a loan of EUR 60 million from ILTE (formerly „Invega“) for investment in the development of the production of the biomethane- and electricity-powered tractor „Auga M1“ appeared about two weeks ago.

The Lithuanian Agricultural Machinery Association (LMAA), which brings together distributors of global tractor manufacturers „John Deere“, „Claas“, „Case IH“, „Massey Ferguson“, „Valtra“ and others, has responded to this news.

„As professionals in our field, representing the world's major agricultural machinery manufacturers, we have seen the hopelessness and unviability of the project ever since the launch of the „Auga M1“ tractor several years ago. „AUGA“ presents this tractor to the Lithuanian audience as an innovation and declares it as an invention of „AUGA“. This is completely untrue," says LFA.According to the association, the „AUGA M1“ tractor is not a creation of „AUGA“, but a basic reworking of the „CLAAS Xerion“ tractor, which is equipped with a gas system.

„The economic logic of such a project can only be viewed with a smile, as the „AUGA M1“ tractor will be the most expensive tractor on the market“, – emphasises the LŽŪTA.

Reasonable doubt

The Association believes that all the major manufacturers, with their huge resources of designers and scientists, are modelling the future fuel prospects, while the „AUGA M1“ is technologically and conceptually very backward. At least that is the impression that the LFA gets.

The Association believes that „decision makers are not so familiar with the market that they would make decisions to allocate €60 million to an unviable project without carrying out a market study or at least an assessment.

„The amount requested for investment is null and void in the competition, as the world's manufacturers have already invested billions and are very far into the future, – adds LFA. – Given the current financial situation of „AUGA“, there are reasonable doubts as to whether the company has the capacity to continue investing, whether it is able to implement the project and what the benefits of the project will be, as there are no prospects in sight“.

Confirmed that it appreciates the projectVictorija Voroncova, a representative of ILTE (formerly „Invega“), confirmed to „Agrobitei“ that this financial project evaluation body is currently examining the application of „AUGA tech“, but no decision has been taken yet on the application.

„No decision has been taken at this stage on the loan application submitted by „AUGA tech" under the „Billion for Business" financing instrument. The application is being evaluated," said Ms Voroncova.

She added that for each application we assess the credit risk „in great detail, assessing whether the project is economically feasible, financially viable and will not cause significant environmental damage“.

„Companies applying for financing must pay sufficient attention to develop a sound business plan that demonstrates the feasibility, returns and market knowledge of the project to be financed“, – highlighted the representative of ILTE.

V. Vorontsova stressed that the viability of a project is not the only thing taken into account when assessing an application. At the same time, we look at the financial performance of the company or group of companies itself, taking into account the audited financial statements submitted with the application," said Ms Vorontsova.

Losses – record for last 7 years

„Agrobite“ has analysed publicly available data on what challenges „AUGA group“ is currently facing.

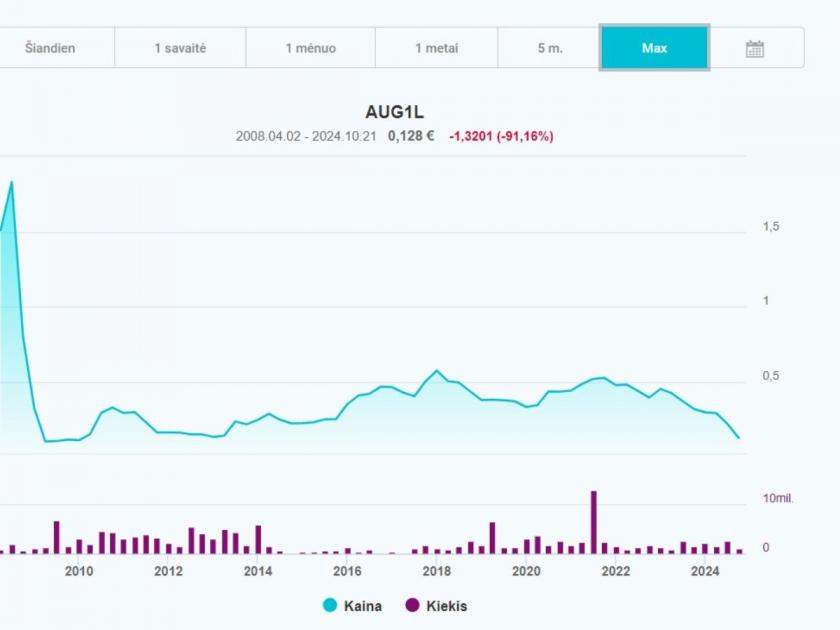

Interestingly, „AUGA group“ shares have depreciated in value by more than 65% over the last 5 years, and since the beginning of trading on the „Nasdaq Baltic“, the shares have lost more than 90% of their value.

For example, Vytautas Plunksnis, chairman of the board of the investors' association, told the media that today „AUGA group“ does not have enough money to cover its debts – its obligations to its creditors have been breached.

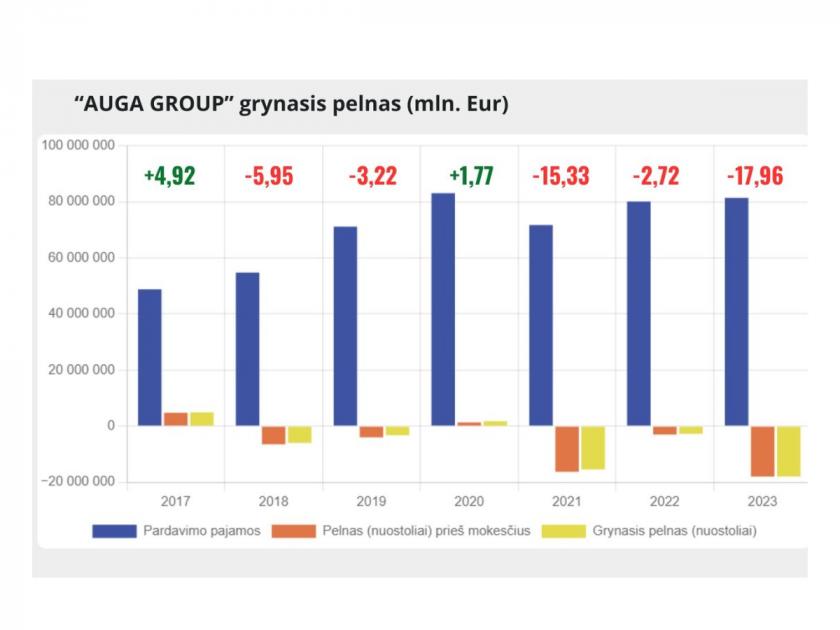

According to Rekvizitai.lt, over the last 3 years "AUGA group" has been operating at a loss.

In 2021, the company made a loss of EUR 15.33 million. In 2022, the loss was a further EUR 2.72 million, and in 2023 the loss was the biggest in the last 7 years, reaching EUR 17.96 million. This alone justifies raising questions that understandably cannot be kind to the „AUGA group“.

When asked whether the group is really threatened with technical bankruptcy, Kęstutis Jusčius, the head of the „AUGA group“, did not reply to „Agrobitei“.

Interestingly, the „AUGA group“ itself promised that the hybrid tractor would be put into mass production in 2022 when it presented the concept of the „AUGA M1“ prototype tractor back in 2021.

The promises were later pushed back to 2023. Earlier this year, the „AUGA group“ announced that mass production of the tractor would start in 2024. In other words, the impression is that it is the promises, not the concrete actions, that have gained the momentum of „mass production“.

No news

The Lithuanian Agricultural Machinery Association stresses that biomethane-powered tractors are not new to the world market.

„Tractor manufacturer „Valtra“ (Finland) developed a prototype back in 2014. The project is currently frozen as unviable for several reasons – the high risk of explosion when working with compressed gas, the market does not show interest and faith in this technology, – says LFTA. – „New Holland“ introduced a series of biomethane-powered tractors a few years ago, one of which is already working in Lithuanian fields“.

But „New Holland“ is investing heavily in biomethane tractor production and technology. According to the association, „New Holland“ believes in this direction in small and medium tractors. However, it is a serial manufacturer and to become one requires investments in the hundreds of millions or billions of dollars.

Other manufacturers are looking to the future with other technologies – „John Deere“ is focusing on the concept of electric tractors, while „Massey Ferguson“ and the AGCO Group are investing in the development of hydrogen-powered tractors.

Is it true what the LFA says?

„Agrobite“ looked into how far „New Holland“ has come.

In March this year, Business Insider" reported that, led by the experience of „New Holland“, the New Zealand dairy company „Bennamann“ will be launching its own dairy business in 2020. In late 2020, New Zealand New Zealand received a grant of nearly €2 million from local government to pilot a project on several „Bennamann“ farms to test the production, storage and sale of biomethane fuel made from cow dung slurry.

The „T7 Methane Power LNG Pre-Production Prototype“ tractor was also in operation here. The feedback has been very favourable, but it should be pointed out that „Bennamann“ has been researching and developing biomethane-only production for more than 10 years, which has been patented by the company.The „T7 Methane Power LNG“ tractor has a preliminary power output of 270 hp, which is considerably more powerful than its predecessor, the „New Holland T6 Methane Power“, with its 180 hp.

It should be recalled that „New Holland“ first announced the employment of green energy in 2006 and in 2013 unveiled the first prototype of a 180 hp methane-powered tractor. So it has taken 11 years for „New Holland“ to increase its power output by more than 66%.

Among other things, it is not yet clear how the next generation „New Holland“ tractor will cope with tillage implements. „New Holland“ has made the most progress in this direction, but the vision for the future of methane-powered tractors is still unrealised today.

The questions were biased rather than an opportunity to dispel doubts

„Agrobitė“ asked „AUGA group“ CEO K. Jusčius very specifically whether the group would have working capital for further development of the project, or would it again rely on loans, and whether the company was in breach of its obligations to creditors? Does the AUGA group have tractor production lines, or is it just an experimental assembly base that fits into one hangar? Finally, what are the patents obtained by „AUGA tech“?

Because usually the major tractor manufacturers who are seeking technological, innovative breakthroughs in the development of methane, hydrogen or electric tractors have established (or acquired as separate companies) technological bases to realise their ambitions. What does the „AUGA group“ – have in terms of buildings, equipment, employees? K. Jusčius, the head of "AUGA group", did not answer all these questions, seeing a trap for "interested groups".

„The questions you have sent are biased and aim to artificially continue a topic that is favourable to interest groups. We have publicly commented on this topic and will not comment further on these questions“, – wrote K. Juščius in his letter.

Even in response to a follow-up request for a public comment by Mr Jusčius, "Agrobitė“ did not receive a specific link."

So is the „AUGA M1“ hybrid tractor really a breakthrough? So far, it looks more like a prop. Especially since the „AUGA group“ itself is reluctant to dispel the doubts that have arisen in the farming community.

What is known about the „AUGA M1“ tractor

There are several press releases issued by the „AUGA group“ concerning the „AUGA M1“ tractor.

In September 2021, the company unveiled a hybrid zero-emission prototype of the „AUGA M1“ tractor, and in November it signed a contract manufacturing agreement with „Rokiškio mašinų Gamylas“. The Rokiškėans have, to the best of public knowledge, supplied only three production units to „AUGA“.

It was later claimed that a team of engineers from the „AUGA group“ had developed a „quick and easy to replace gas cartridge“ which the farmer would be able to obtain from the biomethane plant. Earlier this year, it was announced that the group had patented the tractor's „unique frame design“ in the USA.

No other technologies or innovations in the development of the engine or other components of the tractor have been announced by „AUGA group“. It can therefore be assumed that these are all the specific patents on tractor components reported so far by „AUGA group“.

The factory version of the „AUGA M1“ hybrid tractor includes a „Ford“ internal combustion engine, „Claas“ cab.

What remains unanswered?

It is still unclear what the ILTE will decide on the granting of a loan to „AUGA tech“. The company also refused to comment on the business plan that ILTE submitted with its application. Be that as it may, it has been a recurrent debate in the farming community that, in various forms, most of the support for small and medium sized farms comes from large corporations or their controlled companies and agricultural companies.

„AUGA group“ declares that it owns 162 subsidiaries employing 1 191 people. This represents an average of 7.35 employees per company.If you are curious, these were the questions sent by „Agrobitė“ to the CEO of „AUGA group“, K. Juscis:

•„AUGA group“ company „AUGA tech“ is seeking a loan of 60 million through ILTE (formerly „Invega“) for the development of a biomethane tractor project. Why the decision to apply for such a large loan through the "Billion for Business" financing instrument? There are various assessments on the market, including „AUGA group“ solving its medium-term financial problems with „Billionas verslolui“ money? Please comment.

• Will the „AUGA group“, having received a loan through ILTE, have working capital for the further development of the project, or will it again rely on loans? Please comment.

• Tractors are usually manufactured on production lines. What are the production lines of the „AUGA group“ tractor? Or is it just an experimental assembly base that fits in one hangar?

• Typically, major tractor manufacturers who are seeking technological, innovative advances in methane, hydrogen or electric tractors have established (or acquired as separate companies) technology bases to realise their ambitions. What does the „AUGA group“ – have in terms of buildings, equipment, employees?

• How realistic do you think the technical bankruptcy of the „AUGA group“ is? We are not asking about the historical experience of other companies. We are asking specifically about the financial situation of „AUGA group“?

• Over the last 5 years, „AUGA group“ shares have depreciated by more than 66%. What is the business plan you are basing on to develop the „AUGA M1“ tractor, when it seems that the company itself is in need of help at the moment?

• You told the media that „this technology of the AUGA group is patented in the most important markets for agricultural machinery: USA, Eurasia, China, Australia“. Please be more specific about patents: do you have a patent for the complete development of the tractor, for the development of the engine, or only for a specific part of the tractor, part of the engine or other unique invention. Because if it is, for example, a patent for a complete engine technology, where there is a production line for such an engine, who is going to buy that engine, how is it superior to NEF, FPT, AGCO Power, Mercedes-Benz or other engines? How will you persuade farmers to replace their diesel tractors with a product that has a completely uncertain future? After all, all this (even if we assume that the AUGA M1 project is realistic) also requires infrastructure – fuel stations etc. That's an investment of hundreds of millions, if not billions, just to build the infrastructure, let alone the global markets you're talking about.

• When you applied, you probably also submitted a business plan. It would be really interesting for the farming community to know the details of it. Because if the project fails, it will damage the whole farming community when desperate, unviable projects are funded. Usually, in such cases, a negative general public perception of agriculture is created, that agriculture is a dependent sector.