Dairy market recovers, but Lithuania continues to sink

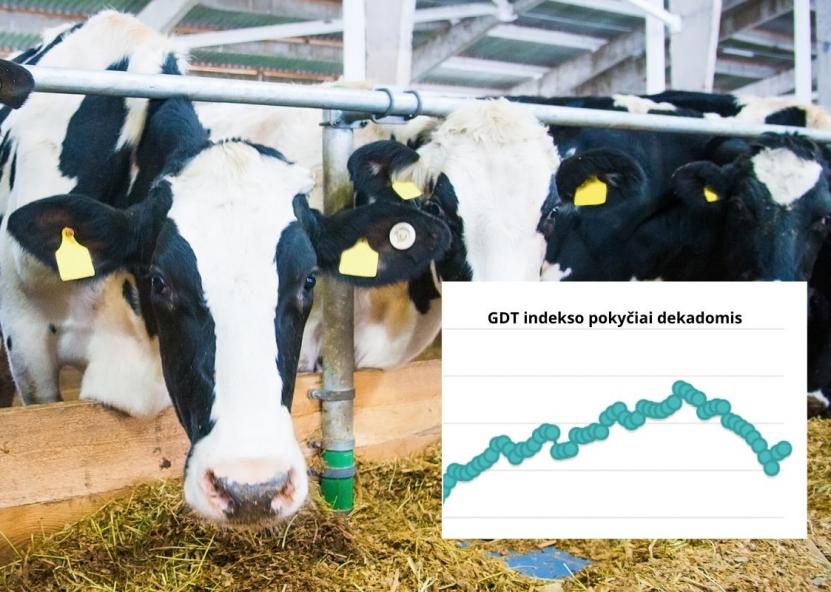

The last trading session of the dairy trading platform „Global Dairy Trade“ (GDT), held on 20 January, gave new optimism to the market – the session closed with a 1.5% increase and the GDT index rose to 1,088 points.

„Agrobite“ recalls that in the previous trading session the index had jumped by as much as 6.3% – to 1 072 points. Two consecutive sessions of growth suggest that demand is gradually strengthening in the global dairy market.

This is particularly significant given that the GDT index has been on a consistent downward trend since its peak of 1 344 points in May 2025, reaching 1 008 points on 16 December 2025. The price increases in recent weeks may signal a possible stabilisation of the market.

The last trading session saw a renewed appreciation of the main commodities – skimmed milk flour appreciated by 2.2%, whole milk flour by 1.0%. These are strategically important dairy products that have a significant impact on the global dairy trade structure and price trends.

The price of butter rose by 2.1% in this session, but the cheese segment showed a weaker sentiment – „Cheddar“ cheeses were down by 1.4% and „Mozzarella“ – by 2.3%.

The GDT platform is owned by the New Zealand cooperative „Fonterra“ and price trends in the Oceania region usually reach Europe after 1.5–2 months. Therefore, recent developments in the global market may have an impact on the European dairy sector in the near future.

Purchase prices in Lithuania – among the lowest in the EU

Despite global signals of recovery, the situation in the Lithuanian dairy sector remains challenging.

According to data from Eurostat, average farm gate prices for raw milk in Lithuania have fallen for three consecutive months. In October 2025, they stood at EUR 49.24 per 100 kg, in November at EUR 47.41 and in December they fell to EUR 44.65.

Lithuania was ranked 23rd out of 26 European Union countries in December 2025 (Luxembourg data not published). This means that milk purchase prices in Lithuania are currently among the lowest in the EU, with an average price of €49.38 per 100 kg.

In comparison, farmers in Latvia were paid an average of €45.30 for milk, in Estonia €49.82 and in Poland €49.72 per 100 kg.

According to Lithuanian milk producers, January 2026 will see a further drop in farm gate prices of 1.5–3 ct per kg. Smaller dairy producers are in some cases not receiving even 20 ct/kg, which raises serious questions about the economic viability of their farms.

When asked to explain why raw milk farm gate prices are being reduced to such an extent, dairy processors did not comment. At the same time, there are signals from the market that prices could be cut even further in the short term.

This situation reveals a structural problem – while the global dairy market is showing cautious signs of recovery, at regional level these processes are not always directly correlated with the prices paid to farmers. However, in the long term, the local market tends to follow overall global trends in one way or another.